Integrated Payments And How Hotels Can Benefit

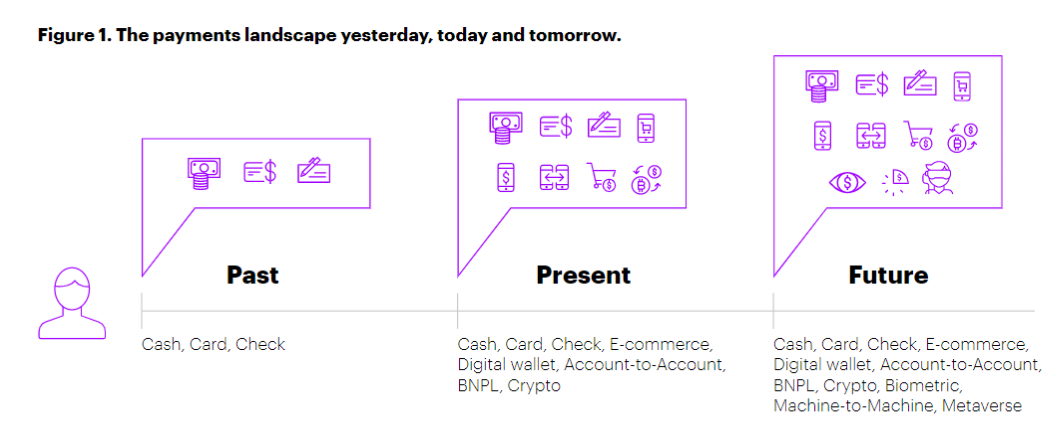

As businesses embrace technology, integrated payment systems have become popular for streamlining financial processes. The hospitality industry is no exception, as integrated payments provide a seamless and secure way for hotels to manage payments and customer data in one place. In the travel and hospitality industry, integrated payment solutions have evolved tremendously over the years, simplifying the accounting process and improving the guest experience.

So, what are integrated payments, and how can hotels benefit?

Integrated payments mean that payment processing can be easily connected with a hotel’s technology stack, such as PMS, IBE, POS, and other software, enabling faster and more secure payment processing. The more integrated your processes are, the better experience your guests will have, especially when it comes to something as delicate as payments. By integrating payments, hoteliers and software companies can deal with fragmented payment providers while simplifying the accounting process.

Benefits of integrated payments in hotels

1. Integrate with your tech stack

An integrated payment solution connected to your business software systems will streamline your operations by taking the manual work away from your hotel front desk, restaurant, spa, or any other services you provide. You will then have the information and data available to improve other areas like accounting or guest experience.

- Streamline operations

With an integrated payment solution, you can better serve your guests by automating time-consuming and repetitive tasks, like manually introducing and processing credit cards. This will help you avoid human errors and process payments more easily, speeding up queues at the front desk when checking in or out or even giving guests the chance to do it themselves through online solutions or self-service kiosks.

- Improve the guest and employee experience

By removing manual work at the front desk, such as processing payments automatically through an integrated payment solution, your employees have more time to take care of your customers, improving their experience at your hotel and avoiding sensitive situations with customers related to payments. Removing repetitive tasks will also improve your staff's satisfaction, allowing them to focus on what is important: providing better service. With a payment integration to your PMS solution, or if you have an online check-in/check-out system, your first and last guest impressions will be great, avoiding long queues when arriving from a long trip or when leaving in a rush.

- Save time and money

Integrated payment solutions automatically connecting with your other hotel software save you time and money. For example, pay-at-table terminal solutions in restaurants connected to a POS or having terminals connected to your PMS for processing payments at your hotel front desk will help you not have to repeat activities when credit cards are not stored and pay on the go, avoiding manual errors, improving customer service and satisfaction while reducing the need for more staff.

- Reduce mistakes

When your restaurant staff or front desk team has peaks of work, it can lead to more human errors, which decrease customer satisfaction while costing you money. Eliminate the risk of potential errors in introducing and processing credit cards by automating payment processes through your system integration to a payment solution. Having an integrated payment system will also help you better manage your accounts, and have clean data, so you can better forecast and make decisions.

- Go contactless

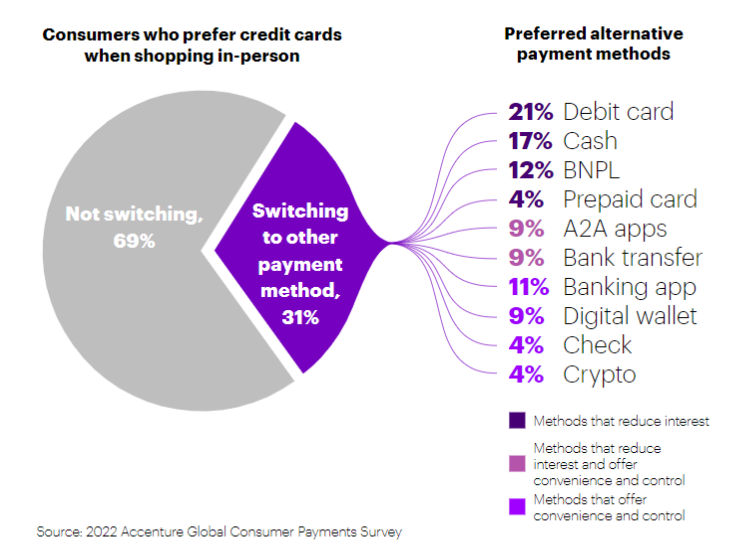

The travel and hospitality industry has been moving towards the adoption of contactless solutions for some time. But with the COVID-19 pandemic, this process has been sped up, especially in payment technology adoption. Integrated payment solutions to SAAS companies, providing the possibility of contactless payments, are now a new requirement in the industry for every business. Giving guests the option of a contactless payment increases guest experience.

7. Reduce accounting work

Using integrated payment solutions in the travel and hospitality industry helps reduce accounting work and increase accuracy while improving employee satisfaction. Manual reconciliation of payment transactions is time-consuming and can lead to errors. On the other hand, integrated payment solutions can automate repetitive tasks, allowing employees to focus on more important matters.

8. Security

Security is a crucial concern for hotels, which manage sensitive information such as credit card and ID numbers. Cybercriminals often target hotels to steal such information. Hotels need to implement secure payment technology policies and procedures to protect customer and business data. Integrated payment solutions can help safeguard sensitive information through SSL and TLS encryption, PCI, PSD2, and DSS compliance, tokenisation, authentication, and encryption methods such as CVV and 3D Secure authentication. In case of fraudulent charges, payment gateways can help handle chargebacks.

How secure are integrated payment systems?

Protecting your customers and business data should always be your top priority. As more credit card purchases occur online, ensuring security and fraud protection is paramount. By implementing secure payment technology policies and procedures within your company, you can guarantee the integrity of present and future transactions.

A Secure Payment System (SPS) is related to payment processing solutions and information technology that helps protect guests' financial and personal data from fraud and unauthorised activities.

Security measures

SSL is necessary to protect customer data by encrypting personal and payment information between the website and the server. Payment processors also use Transport Layer Security (TLS), an updated SSL version, to implement a cryptographic protocol that encrypts and secures data information sent through the websites.

Other ways to assess whether a tool is secure include checking that it is PCI, PSD2, and DSS compliant. These standards are set by card associations like Visa, Mastercard, and American Express to ensure that sensitive payment data is securely processed, transmitted, and stored. The PCI DSS stands for Payment Card Industry Data Security Standards, and the PCI Security Standards Council determines and sets these security standards.

Tokenisation is the process of substituting a sensitive data element with a non-sensitive equivalent, referred to as a token. For instance, substituting a credit card or account number with a token without use and not connected to an account or individual. The customer's 16-digit primary account number (PAN) is substituted with an ID alphanumeric code created randomly. Tokenisation is another essential feature to consider, as it also ensures that credit card data does not remain in your systems.

Authentication and Encryption

Authentication is verifying a user's or machine's identity to ensure they are whom they say they are. Encryption, on the other hand, protects data while maintaining confidentiality and is used to protect data from unauthorised access.

Card Verification Value (CVV) is the most widely used form of card verification, while 3D Secure authentication adds an extra layer of protection for payments. With 3DS enabled, you have 2-step authentication to ensure that the person making the purchase is verified as the owner of the debit or credit card.

Fraud support

With Integrated Payment systems, if a fraudulent charge is made, you will have the help of companies specialised in defending this kind of situation and handling those chargeback attempts. A payment gateway analyses and sends transaction data, card number, and issuing bank information and authorises funds transfer.

Conclusion

Integrated Payment solutions to your different Hotel Systems are key to your business. Hotels need to protect themselves and their clients from criminal attacks, so there is a need to implement security measures. This adds value to your staff by streamlining operations, saving time, and reducing mistakes, which can be invested in improving your guests' experience.

About the Author

Senior Vice President and Practice Head Travel and Hospitality. SCIANT.

Jose Antonio is Senior Vice President and Practice Head Travel and Hospitality in Sciant.

With more than 20 years in the industry, Jose has a great expertise and experience in the Tourism sector. He has gained extensive knowledge working for Hotel Chains and important Global Hotel Software vendors, while teaching several training programs during his whole career, providing him with a comprehensive vision of the Travel & Hospitality Industry.

He is an expert in identifying and understanding the key processes, partners, and technology within the industry, and he excels at integrating and optimizing their operations.

His curiosity and multidisciplinary profile, including extensive experience and knowledge of Management, Operations, Marketing, Sales, and IT, allow him to notice, integrate, and align business needs and turn them into actions for companies' continuous improvement.

SCIANT is a Contributing Member at techtalk.travel

Also make sure to find these supporting content elements of the editorial Integrated Payments in Hospitality

![V03: The History of Hotel & Travel Technology | [Updated] Infographic](https://techtalk.travel/storage/app/uploads/public/63f/e6f/ec8/63fe6fec80447817849943.jpg)

Create an account to access the content.

Get access to Articles, Video's, Podcasts, Think Tanks, Infographics and more.

Click “Sign In” to accept our

Terms of Service Privacy Policy