A game not to bet your house on.

Meta will not save hotels. Online Travel Agencies (OTAs) will remain fierce competitors in the marketplace, and most metas - with the exception of Google - will themselves struggle to grow in their current format without changing post Covid-19.

Over 200,000 hotels vyed for customers’ bookings in pre-COVID-19 Europe, the vast majority being independent hotels. Whilst mastering COVID-19 has been and keeps being the most significant test in history, the more everyday challenges will come to resurface once the pandemic eases. Among those, attracting consumers in a cost-efficient way will be top of mind.

Online marketplaces and aggregators dominate onward distribution, with over half of all hotel bookings going through the likes of Booking Holdings and Expedia Group, Inc and their affiliated companies, the big tour operators, and the two largest accommodation wholesalers in Hotelbeds and Webjet. There has been imagination, possibly even hope, that the global giants may lose market share post the current crisis. However, as can be seen in other sectors - COVID-19 has helped big digital players and large aggregators get fatter. State subsidies have supported the giants; debt financiers have sure-up businesses, and investors are already foreseeing a strong future. This is evidenced in rebounding stock market prices (for example, BKNG - Booking Holdings, Inc. -hitting its highest stock price during the last 12 months).

More so than two years ago, customers today expect a seamless end-to-end consumer journey at the tip of a finger - an experience big-pocket players can more easily provide than single hotels or small chains. Maybe, more importantly, Booking, Expedia, Airbnb, and TripAdvisor have held a marketing scale benefit, and one would expect this to grow as a result of the financial strain caused by COVID-19.

That market power of the big intermediaries - and consequently handing commissions between 15 to 35% to them - leaves hotels with little room to breathe. The alternative appears to be straightforward: promote direct bookings via the hotel website.

But how?

Brand building via offline channels rarely pays off within less than a decade; Google Adwords are notoriously expensive outside of the direct hotel term. Facebook and other social channels are not per se demand-generating in their own right.

Enter: metasearch.

In a way, metasearch is both a potentially highly efficient marketing and distribution channel. “A metasearch engine or website”, as the Siteminder team would put it, “lets travellers compare hotel room rates from various online travel agencies (OTAs) and other booking sites all in one place. A potential guest can use these sites to find room prices from multiple booking options at the same time.”

The utility of the offering is compelling: Overall, the use of metasearch has grown dramatically over the years.

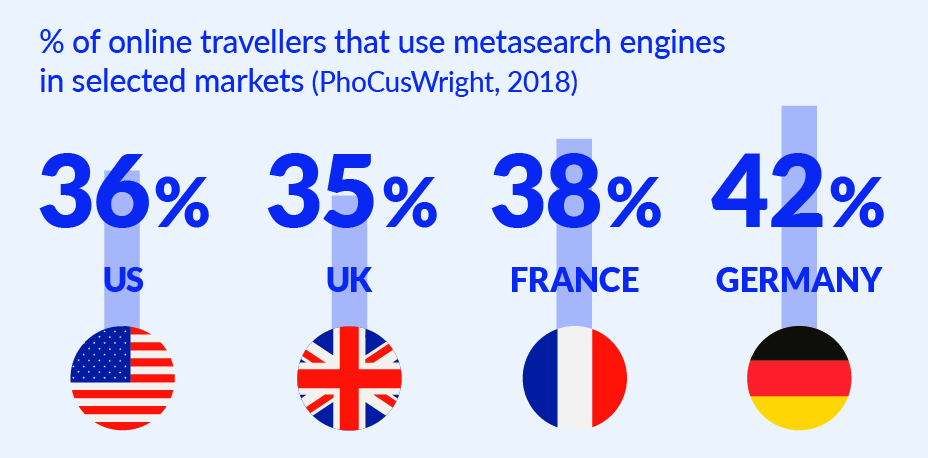

By 2018, 36% of U.S. travellers used metasearch, compared with 35% in the UK and even 42% of German travellers. A 2019 report from EyeforTravel and Fornova even states that 93% of travellers surveyed in Australia, Canada, the UK, and the US were “at least occasional users.”

Since the fourth quarter of 2016, Metasearch has become the most important advertising channel for hotels, outpacing even AdWords, according to a Fastbooking report “The State of Metasearch”.

Consequently, the estimated global metasearch platform revenue in 2019 was bigger than €5b, up 50% vs. 2014. With 12% of all hotel bookings triggered by metasearch, the channel looks like the obvious, possibly the only candidate to boost direct hotel sales efficiently.

And there are dozens of service companies, sophisticated marketing-tech agencies if you will, that support hoteliers in advertising on meta: myhotelshop in Germany, Mirai in Spain, Adshotel in Italy, WHIP/MetaIO in France, Koddi out of the US, to name but a few. These players’ services include media inventory buy, campaign development, management & bidding, price advertising, full-funnel optimisation for better conversion, specialised tracking for metasearch campaigns, and connectivity with dozens of Central Reservation Systems (CRSs) & Internet Booking Engines (IBEs). Most don't have a booking engine or channel manager themselves but are rather compatible with many.

ROAS (Return on Ad Spend) of +10x are commonly advertised by these providers, making metasearch an, in principle, powerfully profitable play. Some other statistics underpin the claim:

- According to some studies, metasearch is on average converting at a rate of 2.2%, the best converting channel from a hotel’s online marketing mix.

- Hotel reservations through metasearch engines assist 25% to other channels (SEO, direct, Adwords “Ads”, Display, among others).

- The booking cancellation ratio through Google Hotel Ads is around 13%, only half compared to a standard OTA booking.

Yet, a deeper look is warranted, asking ourselves three critical questions from the point of view of the long-term efficiency of metasearch for direct hotel sales:

1. How does metasearch make money and maximise its own profits?

2. What does competition look like on metasearches?

3. Will other metasearches survive the rise of Google, or will there be a monopoly like in overall's search?

Besides Google, which we will get to, most big metasearchers are stock-market based companies or parties thereof, notably KAYAK being a daughter company of Booking and Skyscanner belongs to Ctrip (with Booking itself being a large shareholder - circles and round-a-bouts as we say). Hence, they have no intrinsic motivation to cut out the middlemen they belong to - they are simply marketplaces that try to maximise their own return.

Unlike what the term may imply, any metasearch goal is not to make the entire universe of accommodations and platforms that sell these accommodations searchable, but ultimately only those that make good money for the metasearch itself.

One might nonetheless think that the hotel website itself is a logical partner of the metasearch - would customers, after all, not like to engage directly with the hotelier? Well, numbers will tell. Metasearchers are industry leaders in data and test-based decision-making. The answer is often a simple one: the big OTAs convert better and can often afford higher Cost Per Click (CPCs) - hence why would the meta send the customer directly to the hotel?

The most common revenue model of a metasearch is Pay-Per-Click (PPC), and hence only such providers - and hotels - will be showing up prominently that can afford a relatively high CPC. High CPCs, in turn, need to correlate with high conversion; otherwise, the entire marketing channel becomes too expensive for the hotel.

The challenge is compounded by two trends that have shaped metasearchers in the past years.

1. Bidding one's way up has become a common practice on metasearches.

- One can bid for placements on keywords. For example, a hotel may bid on ‘Sydney hotel’ to show up as a top result every time Sydney is searched.

- Bidding one’s way up in circumstances of price parity on one hotel tile is another element, and commonly this favors the big OTAs - who will, if need be, cross-subsidize clicks for thousands of hotels.

- Hiding the cheapest price in favour of the highest CPC result.

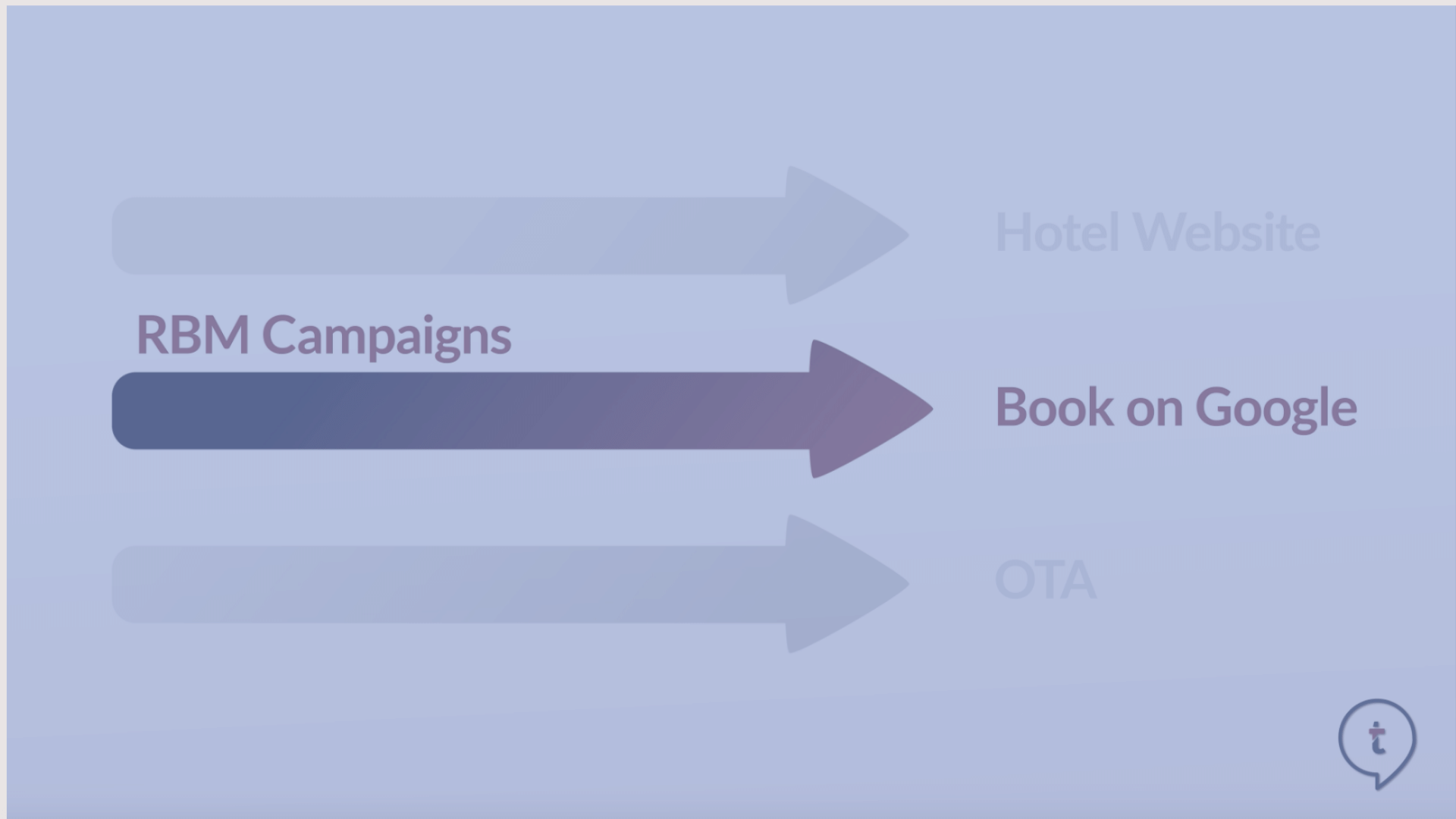

2. Metasearches have moved from pure click-out models to booking on their site (so called 'facilitated booking'). Companies such as TripAdvisor are working on becoming a one-stop shop for researching and booking hotels. Facilitated-book capability has become an increasingly more important requirement of hotels and aggregators who want to successfully compete on meta.

Metasearch is big enough of a channel for the big OTAs - in 2019, an estimated 10% of booking.com’s traffic came from metasearch engines - who themselves hire entire teams of analysts and data scientists that work on Application Programming Interfaces (API) optimization, bidding management algorithms.

Conversely, managing metasearch traffic is a challenge for hoteliers. Hoteliers often lack time, technical and marketing expertise to manage online campaigns. Despite all efforts by marketing agencies, the share of independent hotels on metasearchers has historically been in the single digits - for ALL hotels combined.

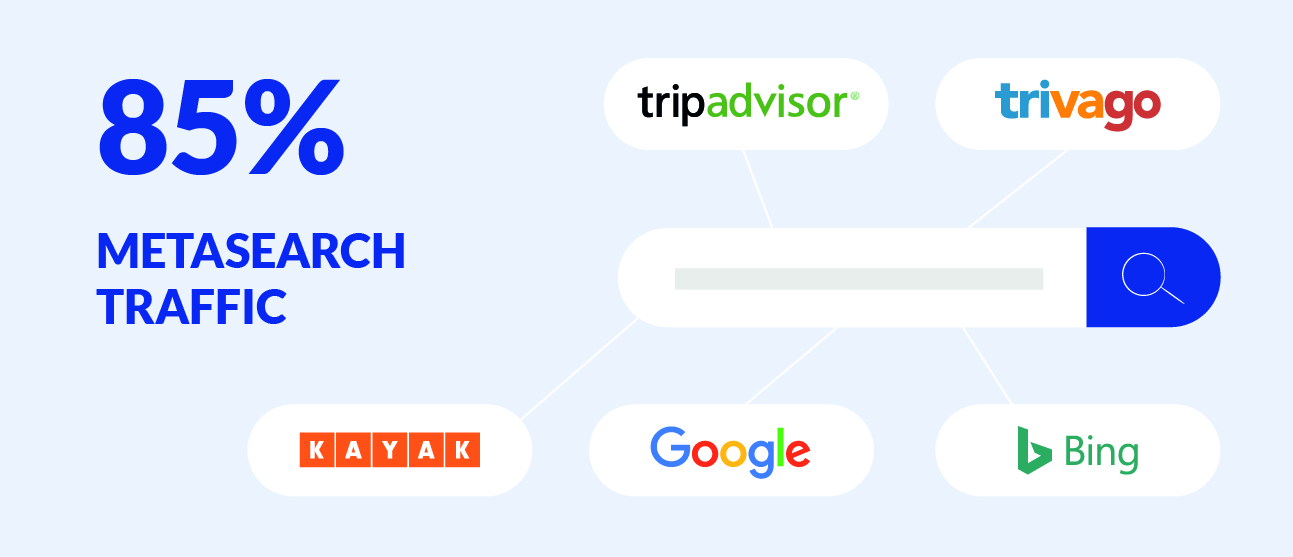

Now, let us take a closer look at the landscape of metasearchers: Revenue is distributed among fewer and fewer players; metasearch is a largely consolidated market today. Some niche players have rather continental reach: e.g. wego (Arabic countries), lilgo (France), travelist (Israel), ixigo (India), and aviasales (Russia), and a few others. Yet, with 85% of all metasearch traffic, the global players Google, KAYAK (after acquiring, consecutively, Sidestep, Checkflix, swoodoo, momondo and hotelscombined over the years), Skyscanner, TripAdvisor and trivago dominate the market. Amongst these global players, again, Google Hotel Ads was the fastest growing metasearch engine with 67% of the meta market in 2020, up from 57% in 2019. It is, according to various sources, also the most profitable meta-channel.

Hence, the question about imminent further consolidation is asked more and more, and here is our prediction: There is no sign that KAYAK, trivago and Co. will gain share against the biggest giant Google, whose role in the overall economy has been strengthened by COVID-19. To not further lose share, they will purchase/consolidate more of the smaller regional players whilst squeezing every cent out of existing provider relationships, including with hotels.

This will not halt the growth of Google Hotels, though, and Google, in turn increasingly. Google Hotel Ads may remain slightly more efficient for hoteliers than Google Adwords, but the natural logic of the marketplace would predict the convergence of pricing.

Obviously, this does not need to mean surrender for every single hotel. The right five-pillar strategy may still bring profitable business.

- Pick the right metasearch for you - e.g. KAYAK may be bigger with US customers, whilst trivago may be bigger with customers from Germany.

- Pick the right tools - the right Property Management System (PMS) and CRS will help monitor the key performance metrics of your channels.

- Pick the right rates - maintain good price parity and rate integrity, including on the room level.

- Pick the right content - strengthen Google Reviews; make sure hotel descriptions and images are updated and accurate on your listings; communicate your room and rate attributes.

- Pick the right strategy - Make sure to claim Google My Business and TripAdvisor Listings; pick the right advertising agency and bidding strategy: top positions are naturally the ones that receive the most clicks, but not necessarily the most profitable ones.

And there may be hope for more competition again. New players may be emerging with better technology that may infringe upon incumbents: Hopper, so far flight heavy, may become a case in point in the accommodation market as well, as much as is the Dutch company Findhotel, which is growing at a decent rate in Europe, or even smaller new entrants like Peakah.com out of Australia.

Furthermore, vacation rental metasearches like Homtetogo have started to also integrate hotel inventory. These channels today lack a sizable hotel-direct portion in their business. But any hotelier longing for a better marketing/distribution mix should keep an eye on the next generation of metasearch. Watch this space.

About the authors

Jan-Frederik Valentin, Partner at HOWZAT ennea Group

Jan-Frederik Valentin is an entrepreneur & marketeer and Founding Partner of Howzat Ennea Group (HEG). Jan‘s notable fields of expertise are Investment, Marketing, Product Development & Change Management. With a team of 11, HEG runs a fund and offers advisory services to startups. A package & flight industry expert, prior to building his own business, Jan ran Global Strategy and Marketing at KAYAK. Before this, Jan had worked in different companies in the travel & and the news industry.

Cassian Silins, Partner at HOWZAT ennea Group

Cassian is an experienced consulting and Hospitality industry expert. Prior to joining Howzat Ennea Cassian ran KAYAK’s hotel business and acted as an advisor in the travel and software industries. Cassian counts such brands as; trivago, SiteMinder, GTA, and Veeve amongst his experience. He combines over 15 years expertise in e-commerce, digital marketing, and business development with a strong PE & VC network in London.

Connect with Cassian on Linkedin.

HOWZAT ennea Group is a Founding Member of techtalk.travel.

Also, find these complementary content elements in Metasearch in Hospitality

- PODCAST l Pablo Delgado from MIRAI; Jens Egemalm from Pandox AB, Cassian Silins from HOWZAT ennea Group discussing Meta Search for Hotels.

- ARTICLE l Metasearch, a game not to bet your house on, written by Jan-Frederik Valentin and Cassian Silins from HOWZAT ennea Group

- VIDEO l Metasearch in Hospitality

- INFOGRAPHIC l Metasearch Customer Journey

Also, find these related editorials

Free download

Free download

![V03: The History of Hotel & Travel Technology | [Updated] Infographic](https://techtalk.travel/storage/app/uploads/public/63f/e6f/ec8/63fe6fec80447817849943.jpg)

Create an account to access the content.

Get access to Articles, Video's, Podcasts, Think Tanks, Infographics and more.

Click “Sign In” to accept our

Terms of Service Privacy Policy