Payments in the Hotel Industry - Are we keeping up?

Shopping and e-commerce as one fast growing part of it, is one of the major pillars of our global economy. We love to spend our hard earned money to buy ourselves or our loved ones beautiful things or just the daily items we need.

No matter what we are purchasing, if it is the milk for our coffee, a gift for our partner or flights and accommodation for our next trip, there is always the disliked time when we have to pay for it.

Usually, it is not the fact itself that one has to pay, but more about how we have to pay.

Imagine you are in a nice department store buying a new jacket, an overall well-orchestrated experience. A polite sales person offering drinks, taking care of your needs as you browse through their merchandise until you have found the jacket you like. The sales person puts your new jacket in a lovely bag covered with a pleasant perfume, all in all, a perfect experience so far. But then it is time to pay. Lucky you, if you are the first person in the queue. If so, you must ask if they are accepting cards since you do not have enough cash on hand for this spontaneous gift to yourself. And if they do generally accept card payments, the next question is do they accept the card you are using. Or maybe you are even one of the advanced people who want to pay with their mobile phones.

And this is the main issue: A gap between the customer’s expectations and deliverables of most industries. It does not matter if we are talking about e-commerce or point of sale, the frustration is almost always the same. The best in-store shopping experience or the best-conversion-drilled web page falls apart if the check-out process does not meet the customer’s expectations.

Looking especially into the battlefield of mobile and digital payments – as these types of payments in some industries will, or already have, created a new era of simplification and convenience for all involved parties, such as customers and merchants. With the introduction of alternative payment methods beside the well-known cash or card transaction, the complexity has increased tremendously, and companies must look into this area quickly.

In the travel sector and especially in the hospitality industry, including restaurants, payment processing is more or less something “just necessary”, where high costs are involved that negatively affect the P&L. It is true – with payment processing, costs always occur. You can, depending on your business model, change the payment processing from something “necessary” to something “helpful” by renaming the costs involved to distribution and marketing costs. Incidentally, cash is also more expensive than you might expect if you are including all indirect costs when it comes to holding cash on hand.

As the topic grows more complex for people outside the payment industry, the number of services offered by companies and start-ups is increasing. The fact that the differentiation between physical and digital shopping experiences and payments is getting harder means it might be easier to just ignore it. But this would be a grave mistake. According to statistics published by Merchant Payments Ecosystem, “nearly 50% of consumers end a transaction if their preferred payment method is not available”. To ignore this fact would mean that you are at risk of losing 50% of your business in the near future.

Talking about the key challenges of this topic, of which there are several, we should start with the right options to offer. It is always about the quality and not the quantity. Implementing different payment methods in e-commerce or at point of sale always requires a high investment of time and money. The acceptance of the offered payment options also differs by your customer’s age and origin. So, it is wise to clearly define your target groups and markets, otherwise you will be overrun by complexity. There is no need and no chance to comply with every expectation, but by offering the right payment methods to the right target group, combined with a fast and easy check-out process on your webpage, you can easily increase your conversion rate by 35%.

If you are not sure about how convenient your check-out and payment process is, just ask your customers. You can use either post booking communication, A/B testing or any other way of communication you feel comfortable with - just ask.

Share of Payment Methods in E-Commerce and Point of Sale showing the increase in the acceptance of eWallets and the decrease of cash payments

Source: WorldPay Global Payment Report 2018, *2018 and **is forecasted for

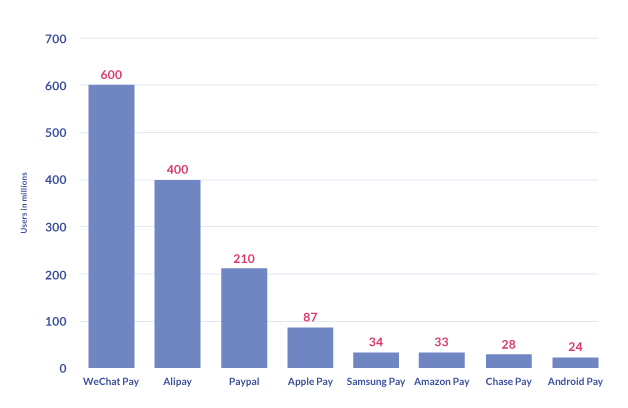

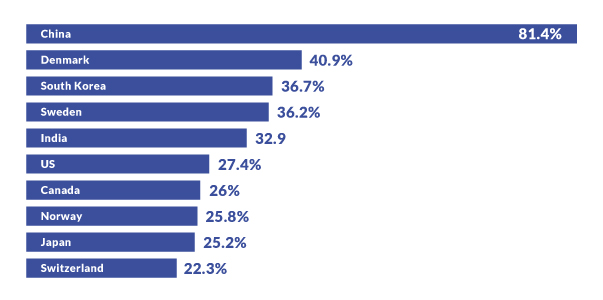

We can learn a lot from China about creating a seamless and fully connected platform landscape including payment processing. As eMarketer recently published, over 80% of the Chinese people are forecasted to use mobile payment solutions via NFC at point of sale by 2019. However, this does not mean that we all must accept Chinese payment methods. It is right that the user adoption of local payment methods in the Chinese market like WeChat Pay or Alipay is way above the average, but this is currently a local phenomenon. In Europe, PayPal for example is more important and truly has to be on your shortlist. Beside PayPal and the Chinese payment methods there are many other options available for e-commerce and point of sale and the well-known card brands are still there.

With Apple Pay, Google Pay, and Amazon Pay, the tech giants stepped into the market utilizing their own ecosystem with iOS and Android to bring simplicity and convenience directly to their customers. They were either able to deliver a solution made for the devices they are operating or the marketplace they are handling. With these major brands entering this market, the development circles are shorter than ever and the pressure to the good old banks has increased tremendously.

Number of users of selected mobile payment platforms in millions

Source: Statista 2020, Worldwide; Juniper Research 2017

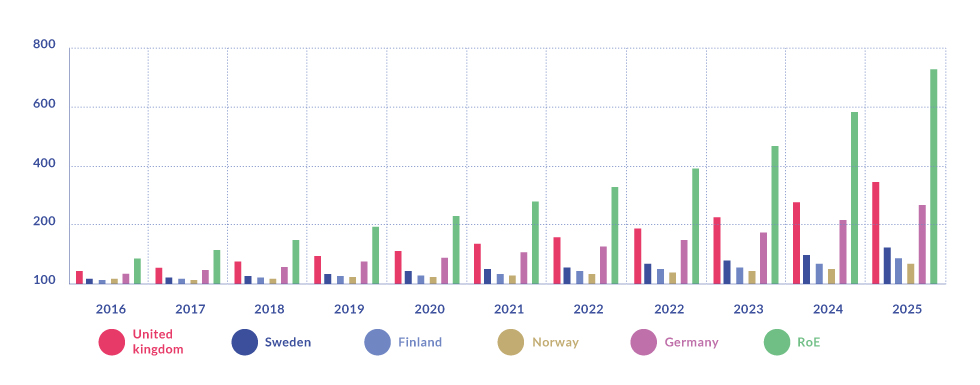

Nonetheless, it is dangerous to ignore the trend of paying mobile - either with a Chinese or Western brand - since we also see a growth in the acceptance of mobile payments in the EU.

Source: Inkwood Research

The acceptance of mobile payments at point of sale is easy. You just need a payment terminal working with NFC (Near Field Communication) and you can accept most of the current mobile payment methods including Apple Pay. Behind most of the mobile payment methods is a credit card stored by the user in the digital wallet and the transaction will be identified as such and can easily be processed. If you do want to accept AliPay or WeChat pay, contact your payment terminal provider to ensure that your terminal is able to read or create QR codes which are used by the Chinese payment schemes.

The integration of alternative payment methods in e-commerce is a bit more advanced but also possible with the right payment service provider as a partner. Start the conversation with your payment vendor to implement alternate payment methods on your brand webpage to ensure that you are offering the payment methods requested by your customer. Do not be afraid if your own skills in web development are not that advanced - most of the payment service providers are offering easy-to-integrate solutions.

Top 10 Countries ranked by proximity mobile payment user penetration, 2019 % of smartphone users

Source: eMarketer

Your task is now to identify your target markets, the customer’s expectations and the required payment methods in e-commerce and at point of sale to offer the right services. If you are expecting Chinese travelers to visit your hotel, restaurant or shop, you should offer Chinese brands and foreign currencies by offering Dynamic Currency Conversion.

With all the potentials raised from offering additional payment methods and enhanced payment programs on your webpage you should not forget that it is always about collecting data. By collecting payment data whether it is online or at the desk, you are requesting a lot of trust from your client. You must take care of the data and ensure that the payment processing runs smoothly and without any friction. Otherwise you will lose the trust of your client and in most cases any future business from them. You can increase trust in e-commerce by using certificates on your web page to show that you are doing the best you can to protect data. You should also investigate the rules of the PCI council (https://www.pcisecuritystandards.org/) and, if you are in the EU, of the Payment Service Directive II (EUR Lex - PSD2), and act strictly in accordance with these regulations. This also will help you to gain trust.

As in many other areas, technology plays a key role in payment processing. Recently I experienced the impact change makes to what is normally a mundane process, to being a more efficient, frictionless experience.

Driving my car into a parking garage I noticed my license plate being scanned at the entrance. Rather than taking a ticket at the machine, I scanned a QR code with my phone, then typed in my license number into the provided fields, which then connected automatically to my Apple Pay account. When leaving the parking garage, my license plate was scanned again at the boom gate. I drove out and immediately received a notification that my Apple Pay account was automatically charged the parking fee.

Why should the travel industry not be able to change their existing well-known processes to a better experience? If you are offering direct payment during the booking process or pre-stay by utilizing self-check-in via web or terminals, make sure you are in line with the customer’s expectations.

By offering frictionless services and creating experiences where the customer can decide whether to pay cash at the desk or use the wallet on their mobile phone without queuing for check-in, you will help build on creating the perfect customer experience whilst focussing on your core expertise: Being a perfect host.

For years the travel industry has the credo to be bookable whenever, wherever and however the customer wants us to be bookable – let’s rethink our understanding of payment processing in the same way. The technology is available. Terminals are able to handle mobile payments and service providers are offering easy-to-use e-commerce solutions. Prepare yourself since this is quite more than just a trend, this is the future of payments.

Source: 1. Merchant Payment Ecosystem.

Source: 2. Baymard InstituteSource: Merchant Payment Ecosystem.

About the Author

Christian Meissner, Senior Director Distribution Products & Digital Payments at Deutsche Hospitality

-

Christian Meissner is Senior Director Distribution Products & Digital Payments at Deutsche Hospitality and responsible for all distribution systems and accounts, customer care and payment services of currently 126 hotels in 14 countries. He is a Certified Payment Professional, educated in Business Information Systems and Economics and a member of the larger board at the Hospitality Sales & Marketing Association (HSMA) Deutschland e.V responsible for Distribution and Revenue Management, as well as a former member of the HEDNA Board of Directors (2017-2019) and active member of the HEDNA Payment working group.

Also, find these complementary content pieces on Payments in the Hospitality Industry:

- INFOGRAPHIC l Future of Payments

- PODCAST l Payments in Hospitality with Rachel Neal from Onyx CenterSource, and Michael Balzer, VP Shiji Payments Solutions

- VIDEO l 'Payments - Going Cashless'

Find all techtalk.travel editorials here.

Free download

Free download

![V03: The History of Hotel & Travel Technology | [Updated] Infographic](https://techtalk.travel/storage/app/uploads/public/63f/e6f/ec8/63fe6fec80447817849943.jpg)

Create an account to access the content.

Get access to Articles, Video's, Podcasts, Think Tanks, Infographics and more.

Click “Sign In” to accept our

Terms of Service Privacy Policy